Data:

Fillable 2021 W4 - Fill and Sign Printable Template Online | US Legal Forms

Are you an Asian individual living in the United States and looking for a convenient way to fill out your 2021 W4 form? Look no further! With the help of US Legal Forms, you can easily fill and sign the fillable 2021 W4 form online.

Are you an Asian individual living in the United States and looking for a convenient way to fill out your 2021 W4 form? Look no further! With the help of US Legal Forms, you can easily fill and sign the fillable 2021 W4 form online.

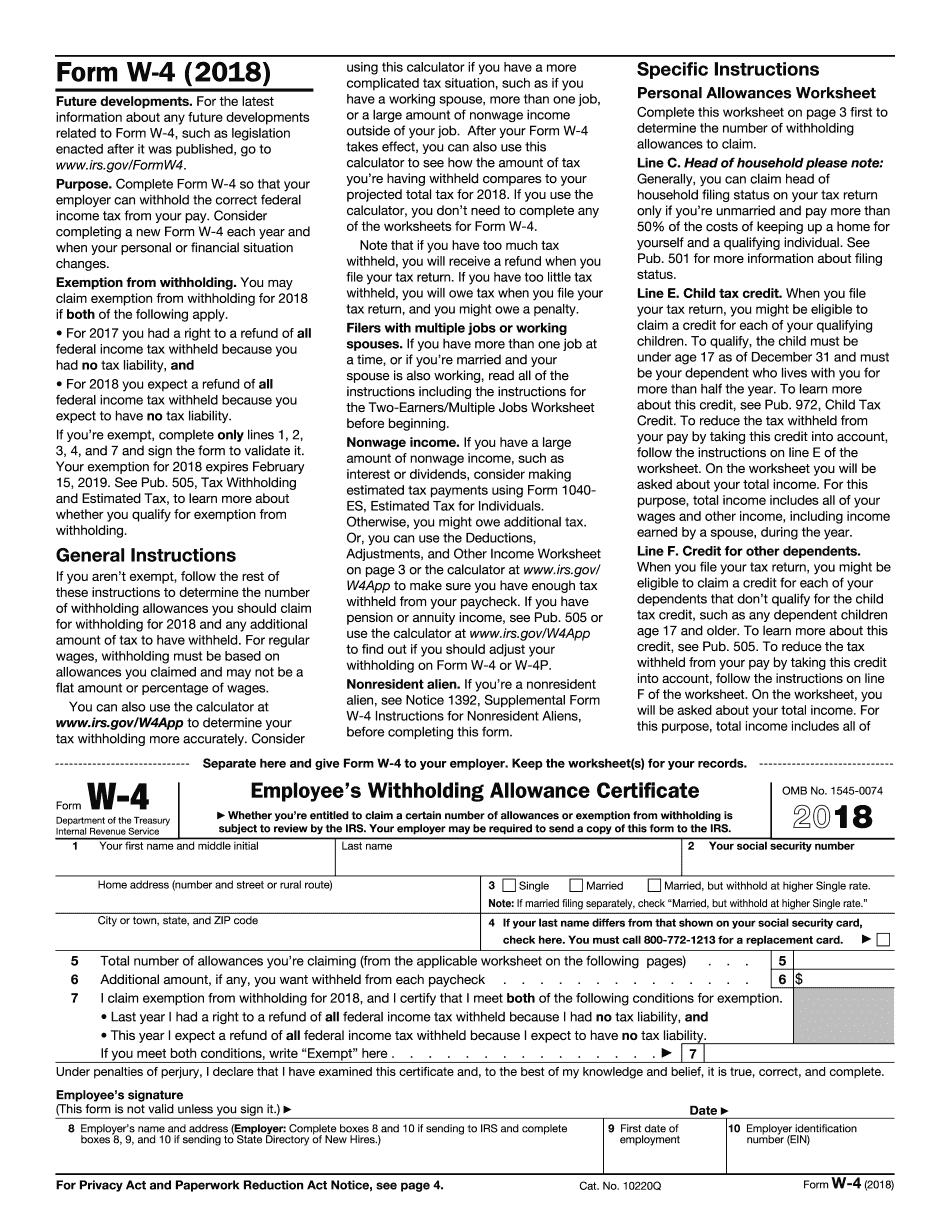

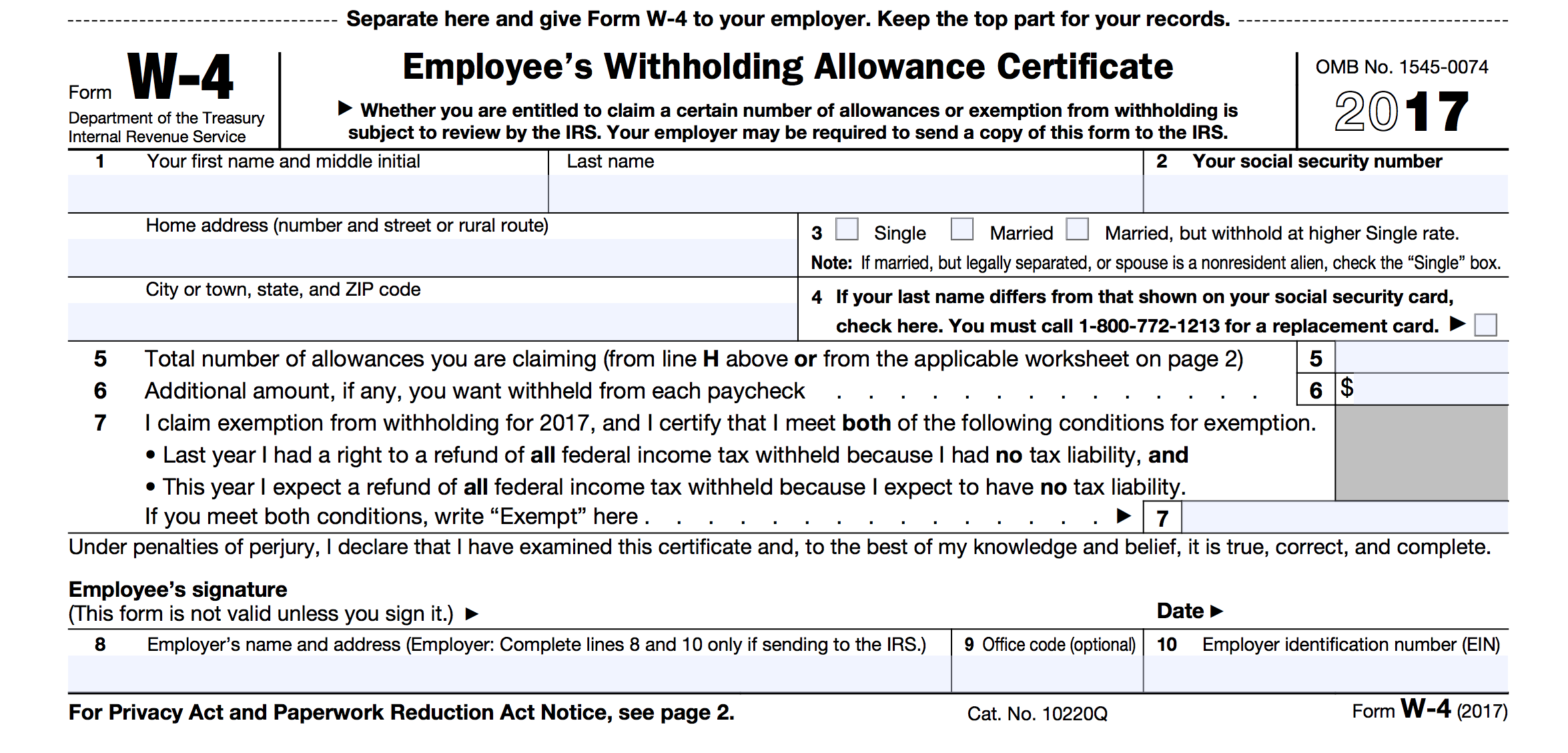

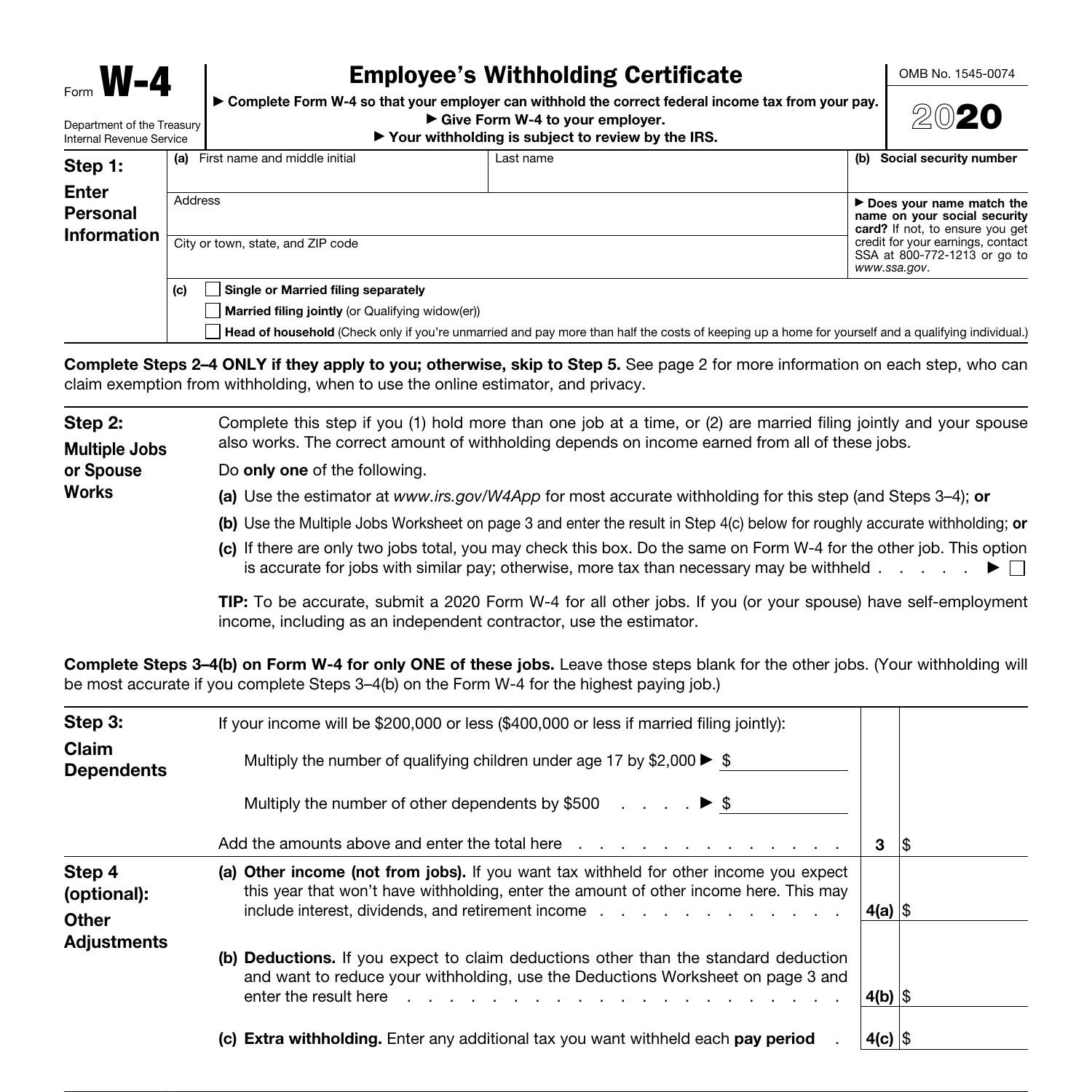

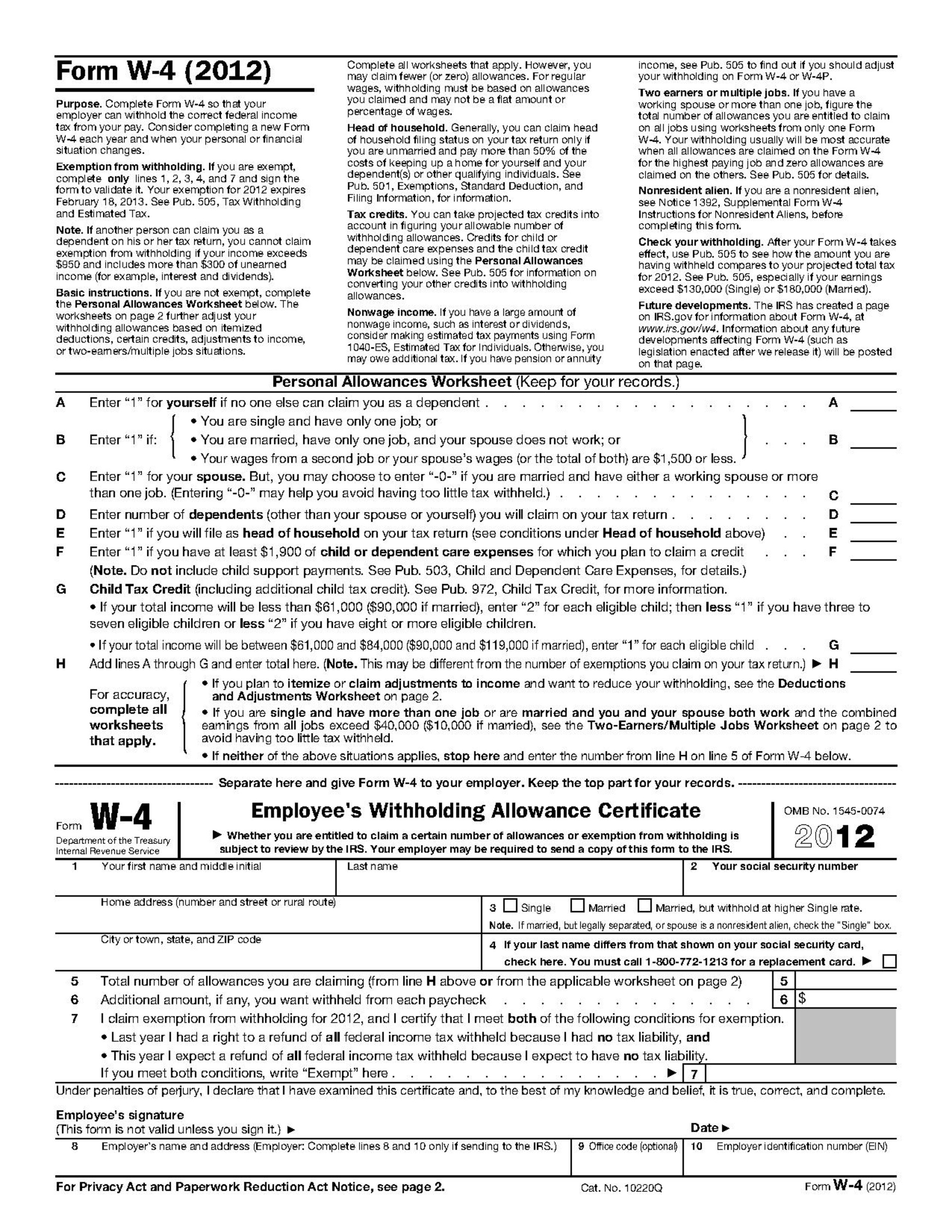

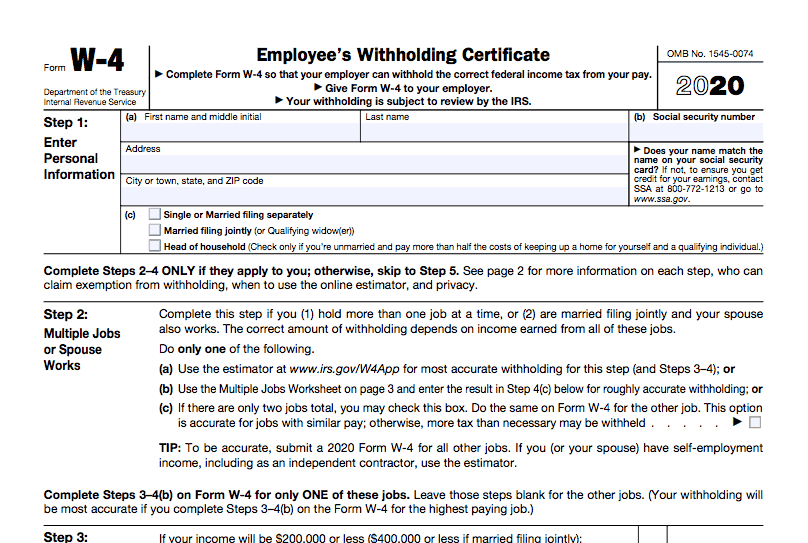

The W4 form, also known as the Employee’s Withholding Certificate, is a form that employees in the United States must complete to indicate their tax withholding preferences. It is used by employers to calculate the amount of federal income tax to withhold from an employee’s paycheck. By accurately filling out the W4 form, you can ensure that you’re withholding the correct amount of taxes from your paycheck.

Filling out the W4 form used to be a time-consuming and tedious process. You had to print out the form, manually fill in all the fields, and then sign it. However, thanks to US Legal Forms, you can now fill and sign the W4 form online in just a few simple steps.

Simply access the fillable 2021 W4 form on the US Legal Forms website and enter your information directly into the form. The form is easy to navigate and includes helpful instructions along the way. Once you’ve completed all the required fields, you can sign the form electronically, eliminating the need for printing and physically signing the document.

Using the US Legal Forms platform to complete your W4 form offers several advantages:

- Convenience: You can fill out the form from the comfort of your own home at any time that suits you. There’s no need to visit an IRS office or complete the form manually.

- Accuracy: The fillable template ensures that you enter the correct information in the right format, reducing the likelihood of errors.

- Efficiency: Filling out the form online saves you time and effort compared to traditional paper forms. It also eliminates the need to mail or fax the form to your employer.

IRS Form W4 2022 - W4 Form 2022 Printable

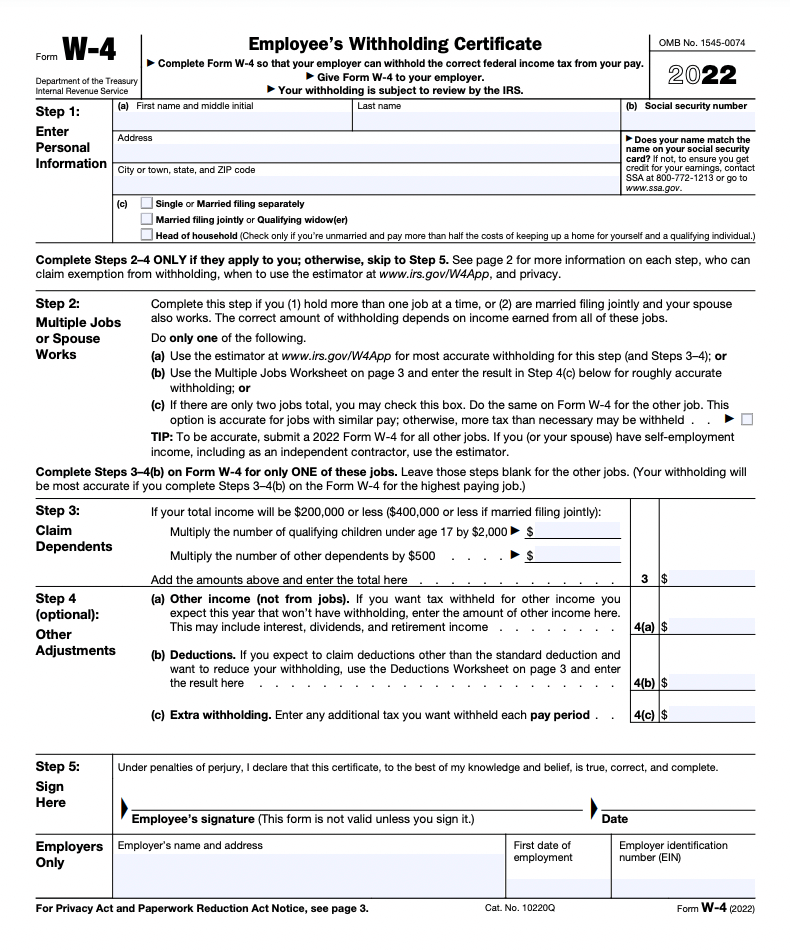

The IRS Form W4 for the year 2022 is now available for printing and filling out. This form is important for employees as it determines the amount of federal income tax that is withheld from their paychecks. By accurately completing this form, you can ensure that you’re paying the correct amount of taxes.

The IRS Form W4 for the year 2022 is now available for printing and filling out. This form is important for employees as it determines the amount of federal income tax that is withheld from their paychecks. By accurately completing this form, you can ensure that you’re paying the correct amount of taxes.

With the W4 form 2022 printable version, you have the flexibility to fill out the form at your convenience. You can easily access the printable form from the W4formprintable.com website and complete it in a few simple steps.

Start by downloading the printable W4 form for 2022 from the website. Then, using a PDF reader or a pen, fill in all the required fields, including your personal information, filing status, and the number of allowances you wish to claim. Be sure to carefully read the instructions and provide accurate information.

Once you’ve completed the form, review it carefully to ensure that all the information is correct. Double-check your Social Security Number, name, and other details to avoid any mistakes. Remember that errors on your W4 form can lead to incorrect withholding, which may result in owing taxes or a large refund when you file your tax return.

W4 Forms 2020 Printable Pdf - 2022 W4 Form

If you’re looking for W4 forms for the year 2020 that are printable in PDF format, you’ve come to the right place. The W4 forms for 2020 are important documents for employees as they determine their federal income tax withholding.

If you’re looking for W4 forms for the year 2020 that are printable in PDF format, you’ve come to the right place. The W4 forms for 2020 are important documents for employees as they determine their federal income tax withholding.

Printing the W4 forms in PDF format is convenient as it allows you to have a physical copy of the form that you can fill out by hand. You can easily access the printable PDF version of the W4 forms from the W4formsprintable.com website.

To get started, download the W4 form for 2020 in PDF format from the website. Then, using a PDF reader or a pen, fill in the required fields, including your personal information, filing status, and the number of allowances you wish to claim. Take your time to ensure that all the information is accurately provided.

Review the completed form carefully to make sure there are no errors or missing information. Double-check your Social Security Number, name, and other details to avoid any mistakes. It’s crucial to provide accurate information on your W4 form as errors may lead to incorrect withholding and potential issues with your taxes.

What Is Form W-4 and How to Fill It In in 2022?

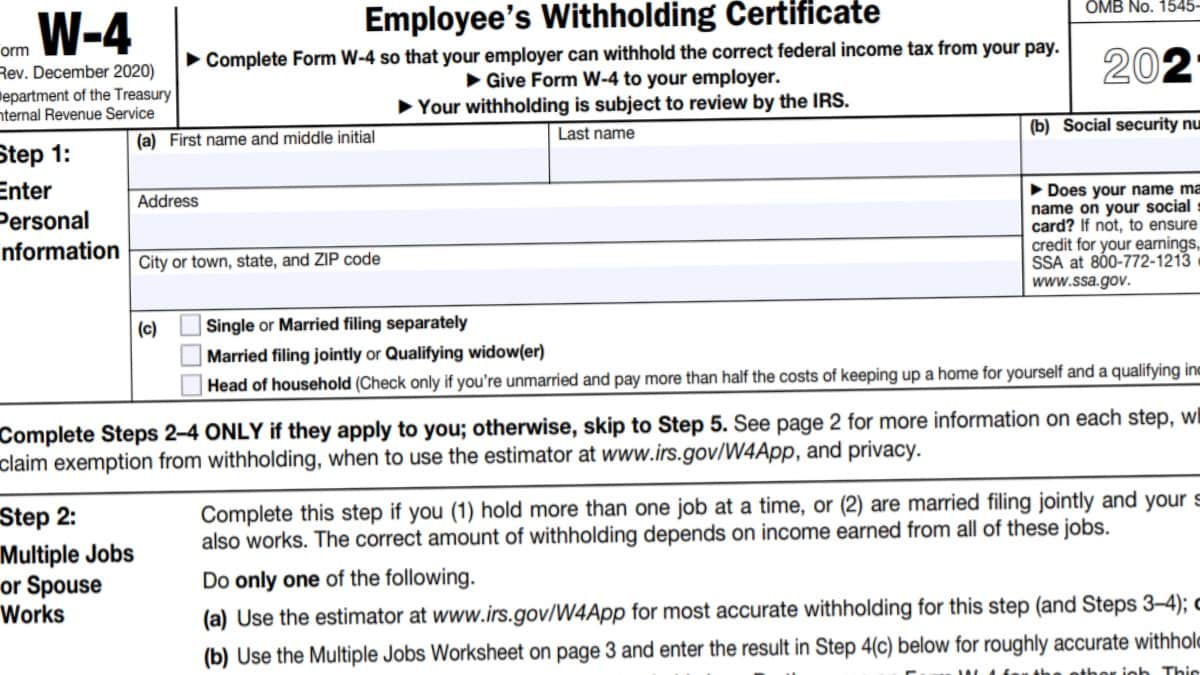

Form W-4, also known as the Employee’s Withholding Certificate, is an important document that employees in the United States need to fill out to instruct their employers on how much federal income tax should be withheld from their paychecks.

If you’re unsure of how to fill out Form W-4 in 2022, don’t worry - we’ve got you covered. Here’s a step-by-step guide to help you navigate the process.

Step 1: Provide personal information

Start by entering your name, Social Security Number, and address on the first section of the form. Make sure to use your legal name and provide accurate information.

Step 2: Choose your filing status

Indicate your filing status in the second section of the form. Your filing status determines the tax rate that will be applied to your income. The options include Single, Married Filing Jointly, and Head of Household, among others. Select the appropriate status based on your situation.

Step 3: Declare any dependents

If you have any dependents, such as children, you can claim them on your Form W-4. This can help reduce the amount of tax withheld from your paycheck. In this section, you’ll need to provide the number of dependents you have.

Step 4: Account for additional income

If you have additional income from other jobs or sources, you can account for it in this section. This step ensures that enough tax is withheld to cover your total tax liability.

Step 5: Make adjustments and sign the form

If you want to make any additional adjustments to your withholding, you can do so in this section. This may include indicating additional withholdings or exemptions. Once you’ve reviewed the form and made any necessary adjustments, sign and date it.

Following these steps will ensure that you accurately fill out Form W-4 in 2022. Remember, it’s important to review your form carefully to avoid errors that may result in incorrect tax withholding.

W4 Form 2020 - W-4 Forms - TaxUni

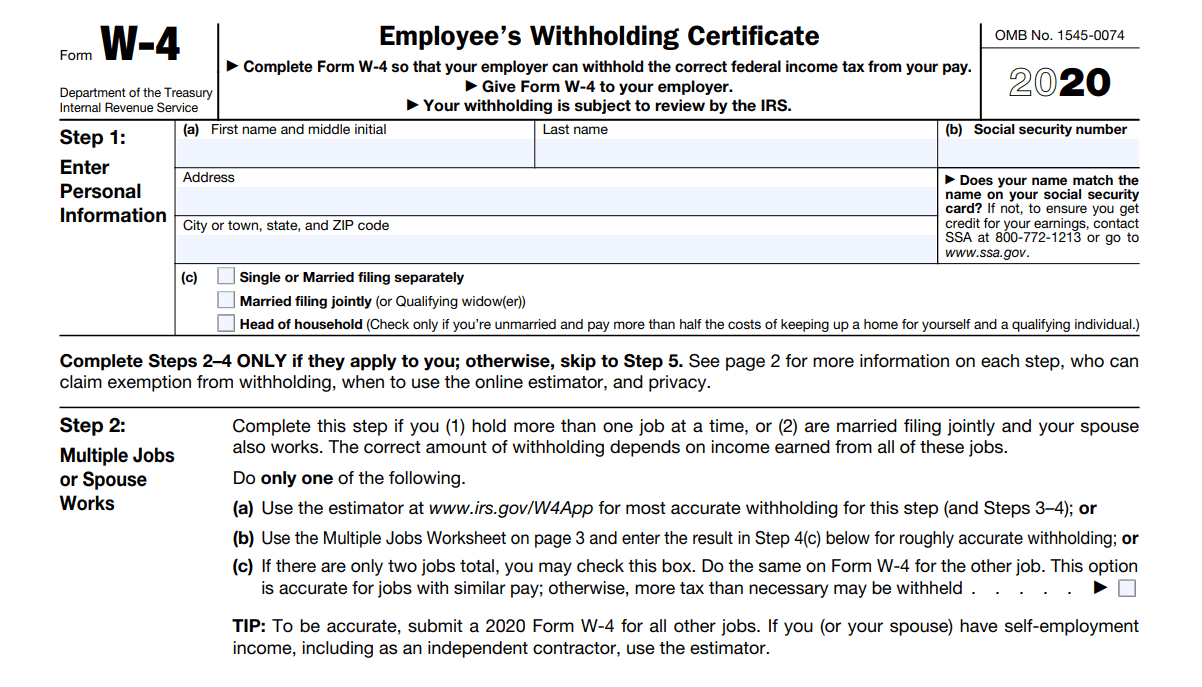

The W4 form for the year 2020 is an essential document for employees in the United States. It is used by employers to determine the amount of federal income tax to withhold from an employee’s paycheck. If you need to fill out the W4 form for 2020, you’re in the right place.

The W4 form for the year 2020 is an essential document for employees in the United States. It is used by employers to determine the amount of federal income tax to withhold from an employee’s paycheck. If you need to fill out the W4 form for 2020, you’re in the right place.

At TaxUni, we provide you with a comprehensive guide and printable version of the W4 form for 2020. Our website offers an easy-to-use platform where you can access the form and complete it step-by-step.

To get started, visit the TaxUni website and download the printable W4 form for 2020. Then, using a pen or a PDF reader, fill in the required fields on the form. Provide accurate information regarding your personal details, filing status, and the number of allowances you wish to claim. Take your time to ensure that all the information is correct and complete.

Once you’ve filled out the form, carefully review it to check for any errors or missing information. Pay close attention to your Social Security Number, name, and other details to avoid any mistakes. Submitting an accurate W4 form is crucial, as it ensures that the correct amount of tax is withheld from your paycheck.

Printable 2020 W4 Form - 2022 W4 Form

If you’re an employee in the United States and you’re required to fill out a W4 form for the year 2020, we’ve got you covered. At W4formsprintable.com, you can easily access and print the 2020 W4 form.

If you’re an employee in the United States and you’re required to fill out a W4 form for the year 2020, we’ve got you covered. At W4formsprintable.com, you can easily access and print the 2020 W4 form.

The W4 form is an essential document that helps determine the amount of federal income tax to withhold from your paycheck. By accurately completing the W4 form, you ensure that the correct amount of tax is withheld, avoiding any surprises when it comes time to file your tax return.

To get started, visit W4formsprintable.com and download the printable 2020 W4 form. Then, using a pen or a PDF reader, fill in the required fields on the form. Make sure to provide accurate information, including your personal details, filing status, and the number of allowances you wish to claim.

After completing the form, carefully review it to ensure that all the information is accurate and complete. Double-check your Social Security Number, name, and other details to avoid any mistakes. Submitting an error-free W4 form is important in order to have the correct amount of tax withheld from your paycheck.

Printable W 4 Forms - 2022 W4 Form

If you’re an Asian individual working in the United States, it’s crucial to understand and correctly fill out the W4 form. The W4 form is used by employers to determine the amount of federal income tax to withhold from your wages. To simplify the process, printable W4 forms are available.

If you’re an Asian individual working in the United States, it’s crucial to understand and correctly fill out the W4 form. The W4 form is used by employers to determine the amount of federal income tax to withhold from your wages. To simplify the process, printable W4 forms are available.

At W4formsprintable.com, you can access printable W4 forms that are easy to understand and complete. By following the provided instructions, you’ll be able to accurately fill out the form.

Start by downloading the printable W4 form from the website. Then, using a pen or PDF reader, fill in the necessary details. Provide accurate information regarding your personal details, including your name, address, and Social Security Number. Indicate your filing status and the number of allowances you wish to claim.

Once you’ve completed the form, carefully review it to ensure that all information is accurate and complete. Ensure that you’ve signed and dated the form before submitting it to your employer. Submitting an accurately filled out W4 form will help ensure that the correct amount of tax is withheld from your wages.

Form W4 2020.pdf | DocDroid

If you’re an employee in the United States and need to fill out Form W4 for the year 2020, you can access a PDF version of the form on DocDroid. The PDF format allows for easy printing and filling in by hand.

If you’re an employee in the United States and need to fill out Form W4 for the year 2020, you can access a PDF version of the form on DocDroid. The PDF format allows for easy printing and filling in by hand.

Start by downloading the Form W4 2020 PDF from DocDroid. Then, print the form and fill in the required fields using a pen. Make sure to provide accurate information regarding your personal details, filing status, and the number of allowances you wish to claim.

Review the completed form thoroughly to ensure that all the information is correct and complete. Double-check your Social Security Number, name, and other details to avoid any mistakes. Providing accurate information on your W4 form is essential to ensure that the correct amount of tax is withheld from your paychecks.

Illinois W4 Form 2021 Printable - 2022 W4 Form

Attention, residents of Illinois! If you live and work in Illinois and need to fill out a W4 form for the year 2021, you can easily access and print the form from W4formsprintable.com.

Attention, residents of Illinois! If you live and work in Illinois and need to fill out a W4 form for the year 2021, you can easily access and print the form from W4formsprintable.com.

The Illinois W4 form is similar to the federal W4 form, but it is specifically designed for Illinois residents. By accurately completing the Illinois W4 form, you ensure that the correct amount of state income tax is withheld from your paycheck.

To get started, visit W4formsprintable.com and download the printable Illinois W4 form for 2021. Then, using a pen or a PDF reader, fill in the required fields on the form. Provide accurate information regarding your personal details, filing status, and the number of allowances you wish to claim.

After completing the form, carefully review it to ensure that all the information is accurate and complete. Double-check your Social Security Number, name, and other details to avoid any mistakes. Submitting an error-free Illinois W4 form is important to ensure that the correct amount of state income tax is withheld from your paycheck.

2020 Federal W 4 Forms Printable - 2022 W4 Form

If you need to fill out the federal W4 form for the year 2020, you can easily access printable versions of the form on W4formsprintable.com. By filling out the W4 form accurately, you ensure that the correct amount of federal income tax is withheld from your payment.

If you need to fill out the federal W4 form for the year 2020, you can easily access printable versions of the form on W4formsprintable.com. By filling out the W4 form accurately, you ensure that the correct amount of federal income tax is withheld from your payment.

To get started, download the printable version of the federal W4 form for 2020 from W4formsprintable.com. Once you have the form, you can fill it out by