As we approach tax season, it is essential for all of us, including Asian people living in the United States, to familiarize ourselves with the necessary paperwork and forms required for filing our income taxes. In this post, we will explore several important forms for Pennsylvania state taxes, specifically for the year 2020.

- PA-1000: 2016 Property Tax or Rent Rebate Claim

The PA-1000 form is designed to help eligible residents of Pennsylvania claim property tax or rent rebates. This form can assist individuals who meet specific income requirements in offsetting the burden of property taxes or rent payments. By filling out this form accurately, eligible individuals can receive substantial rebates, providing much-needed financial relief.

The PA-1000 form is designed to help eligible residents of Pennsylvania claim property tax or rent rebates. This form can assist individuals who meet specific income requirements in offsetting the burden of property taxes or rent payments. By filling out this form accurately, eligible individuals can receive substantial rebates, providing much-needed financial relief.

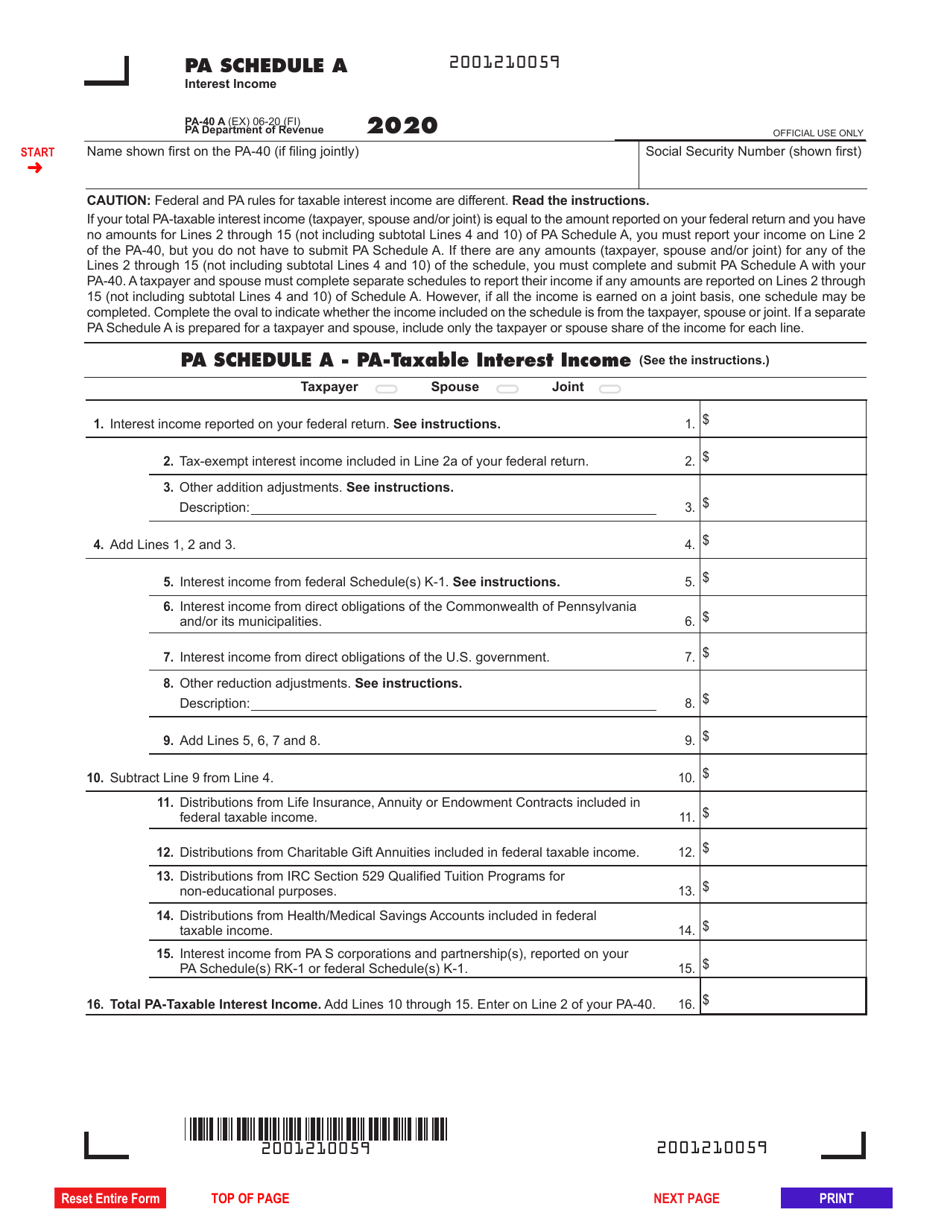

- Form PA-40 Schedule A: Interest Income

If you have earned interest income in Pennsylvania, it is crucial to report it accurately to the state tax authorities. Form PA-40 Schedule A allows you to itemize your interest income, ensuring compliance with state tax regulations. By carefully documenting and reporting your interest income using this form, you can avoid penalties or legal complications in the tax filing process.

If you have earned interest income in Pennsylvania, it is crucial to report it accurately to the state tax authorities. Form PA-40 Schedule A allows you to itemize your interest income, ensuring compliance with state tax regulations. By carefully documenting and reporting your interest income using this form, you can avoid penalties or legal complications in the tax filing process.

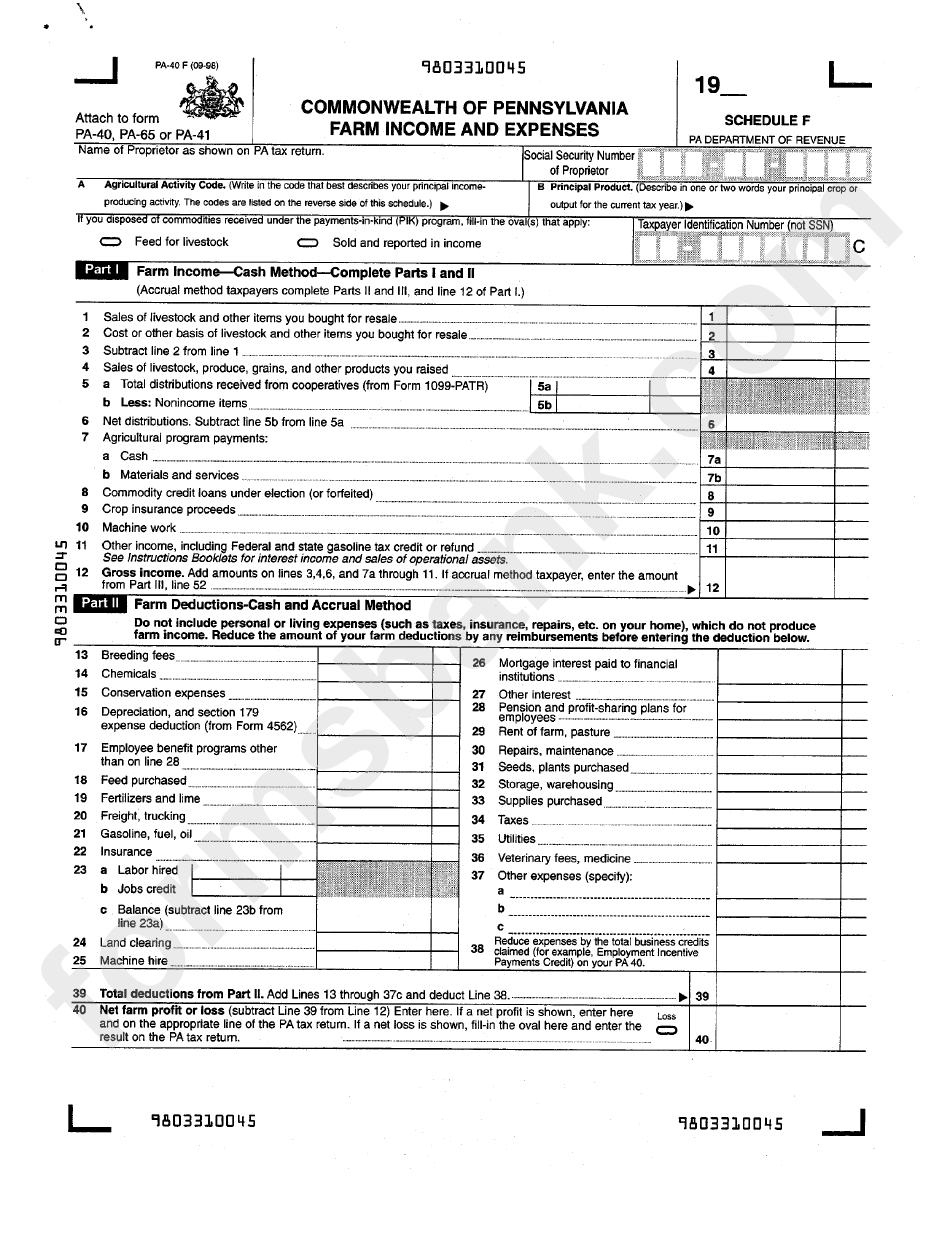

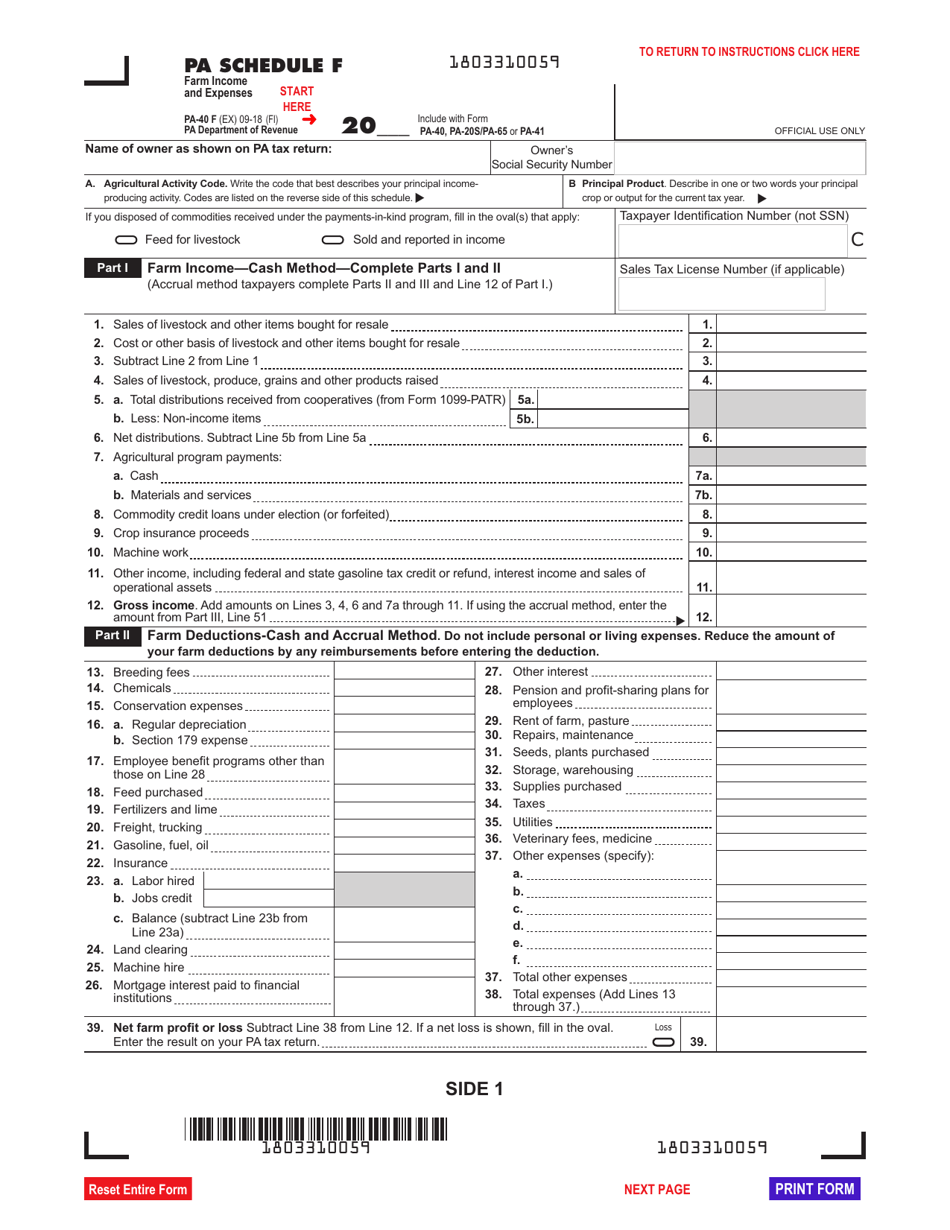

- Fillable Form PA-40 F: Pennsylvania Farm Income And Expenses

For those engaged in farming activities in Pennsylvania, reporting farm income and expenses is essential for tax purposes. Form PA-40 F allows farmers to carefully detail their income and expenses related to agricultural activities. By accurately completing this form, farmers can ensure that their tax filings are in line with the Pennsylvania state tax regulations, enabling a smooth and compliant tax season.

For those engaged in farming activities in Pennsylvania, reporting farm income and expenses is essential for tax purposes. Form PA-40 F allows farmers to carefully detail their income and expenses related to agricultural activities. By accurately completing this form, farmers can ensure that their tax filings are in line with the Pennsylvania state tax regulations, enabling a smooth and compliant tax season.

- PA PA-40/PA-41 OC 2020-2022: Fillable Template Online

The PA PA-40/PA-41 OC 2020-2022 form is a comprehensive template that covers various income types, deductions, and credits for individuals filing their state taxes in Pennsylvania. This fillable template allows for convenient online completion, making the tax filing process easier and more efficient. By utilizing this form, Asian people in Pennsylvania can ensure that their tax returns are accurate and comply with state regulations.

The PA PA-40/PA-41 OC 2020-2022 form is a comprehensive template that covers various income types, deductions, and credits for individuals filing their state taxes in Pennsylvania. This fillable template allows for convenient online completion, making the tax filing process easier and more efficient. By utilizing this form, Asian people in Pennsylvania can ensure that their tax returns are accurate and comply with state regulations.

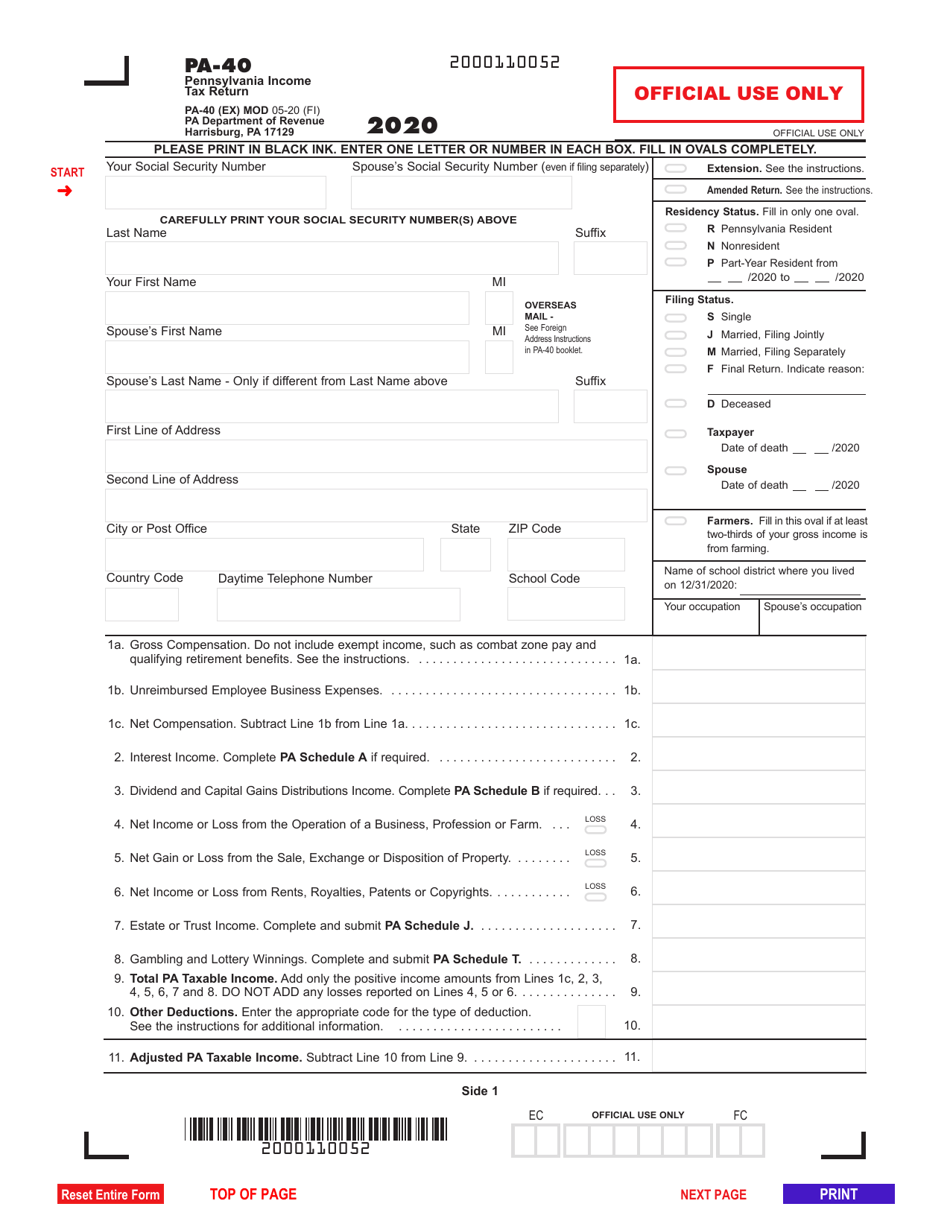

- PA-40: 2014 Pennsylvania Income Tax Return

Although this form is from 2014, it can still serve as a valuable reference for Asian people residing in Pennsylvania. The PA-40 form is used to file individual income tax returns for the state of Pennsylvania. By thoroughly completing this form, taxpayers can report their income, deductions, and credits accurately. While using the most recent form is generally recommended, understanding the components of older forms can provide a valuable foundation.

Although this form is from 2014, it can still serve as a valuable reference for Asian people residing in Pennsylvania. The PA-40 form is used to file individual income tax returns for the state of Pennsylvania. By thoroughly completing this form, taxpayers can report their income, deductions, and credits accurately. While using the most recent form is generally recommended, understanding the components of older forms can provide a valuable foundation.

- Pa 40 Tax Form: Printable Forms Free Online

If you prefer printable forms, the Pa 40 Tax Form provides an accessible and user-friendly option for filing your Pennsylvania state taxes. By accessing this printable form online, Asian people in Pennsylvania can easily complete their tax returns at their convenience. Make sure to accurately print and fill out all the required sections to avoid any discrepancies or errors in your tax filings.

If you prefer printable forms, the Pa 40 Tax Form provides an accessible and user-friendly option for filing your Pennsylvania state taxes. By accessing this printable form online, Asian people in Pennsylvania can easily complete their tax returns at their convenience. Make sure to accurately print and fill out all the required sections to avoid any discrepancies or errors in your tax filings.

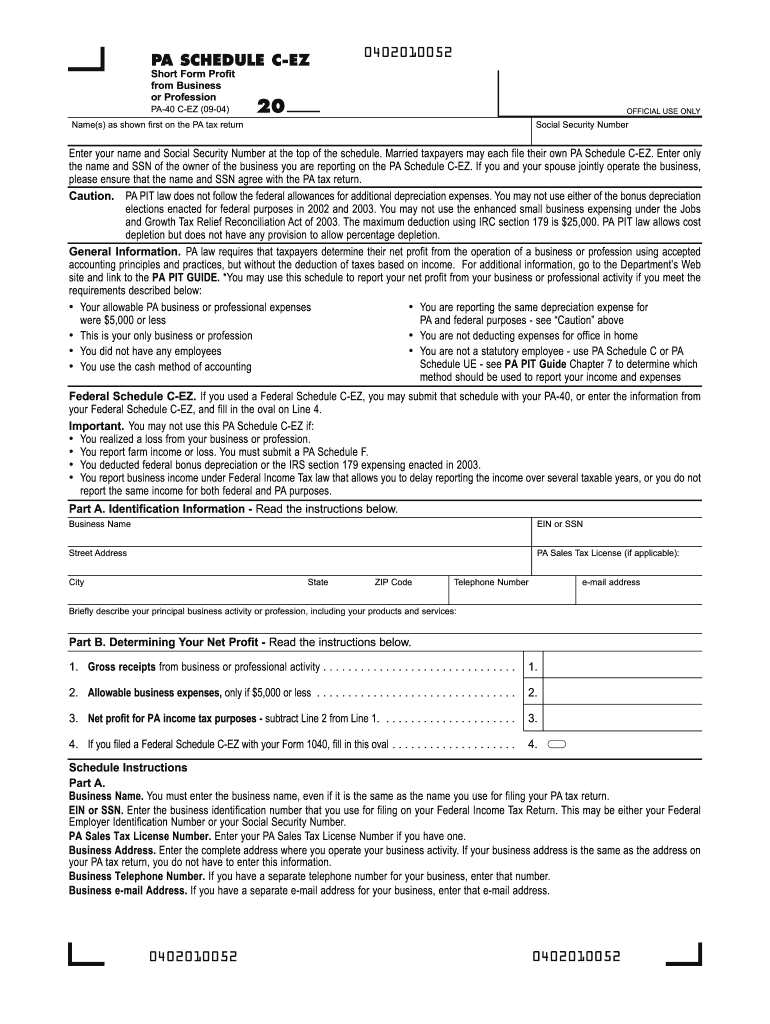

- Pa Schedule C EZ Form: Printable PDF Template

For individuals with self-employment income or small businesses operating in Pennsylvania, form Pa Schedule C EZ plays a crucial role. This form allows small business owners to report their business income, expenses, and deductions. By completing this form appropriately, Asian entrepreneurs in Pennsylvania can accurately report their business income and ensure they take advantage of eligible deductions.

For individuals with self-employment income or small businesses operating in Pennsylvania, form Pa Schedule C EZ plays a crucial role. This form allows small business owners to report their business income, expenses, and deductions. By completing this form appropriately, Asian entrepreneurs in Pennsylvania can accurately report their business income and ensure they take advantage of eligible deductions.

- 2021 PA Form PA-40 ES (I): Fill Online, Printable, Fillable, Blank

Estimated tax payments are an essential aspect of the tax process, especially for individuals with complex financial situations. The 2021 PA Form PA-40 ES (I) allows taxpayers to make these estimated tax payments easily. By utilizing this form, Asian people in Pennsylvania can calculate their estimated tax liability and ensure timely payment, avoiding any penalties or interest charges.

Estimated tax payments are an essential aspect of the tax process, especially for individuals with complex financial situations. The 2021 PA Form PA-40 ES (I) allows taxpayers to make these estimated tax payments easily. By utilizing this form, Asian people in Pennsylvania can calculate their estimated tax liability and ensure timely payment, avoiding any penalties or interest charges.

- Form PA-40 Schedule F: Farm Income And Expenses

For individuals engaged in farming activities in Pennsylvania, accurately reporting farm income and expenses is vital. The Form PA-40 Schedule F enables farmers to document all relevant details related to their agricultural income and expenses. By diligently completing this form, Asian farmers in Pennsylvania can ensure that their tax returns comply with state regulations and accurately reflect their financial activities.

For individuals engaged in farming activities in Pennsylvania, accurately reporting farm income and expenses is vital. The Form PA-40 Schedule F enables farmers to document all relevant details related to their agricultural income and expenses. By diligently completing this form, Asian farmers in Pennsylvania can ensure that their tax returns comply with state regulations and accurately reflect their financial activities.

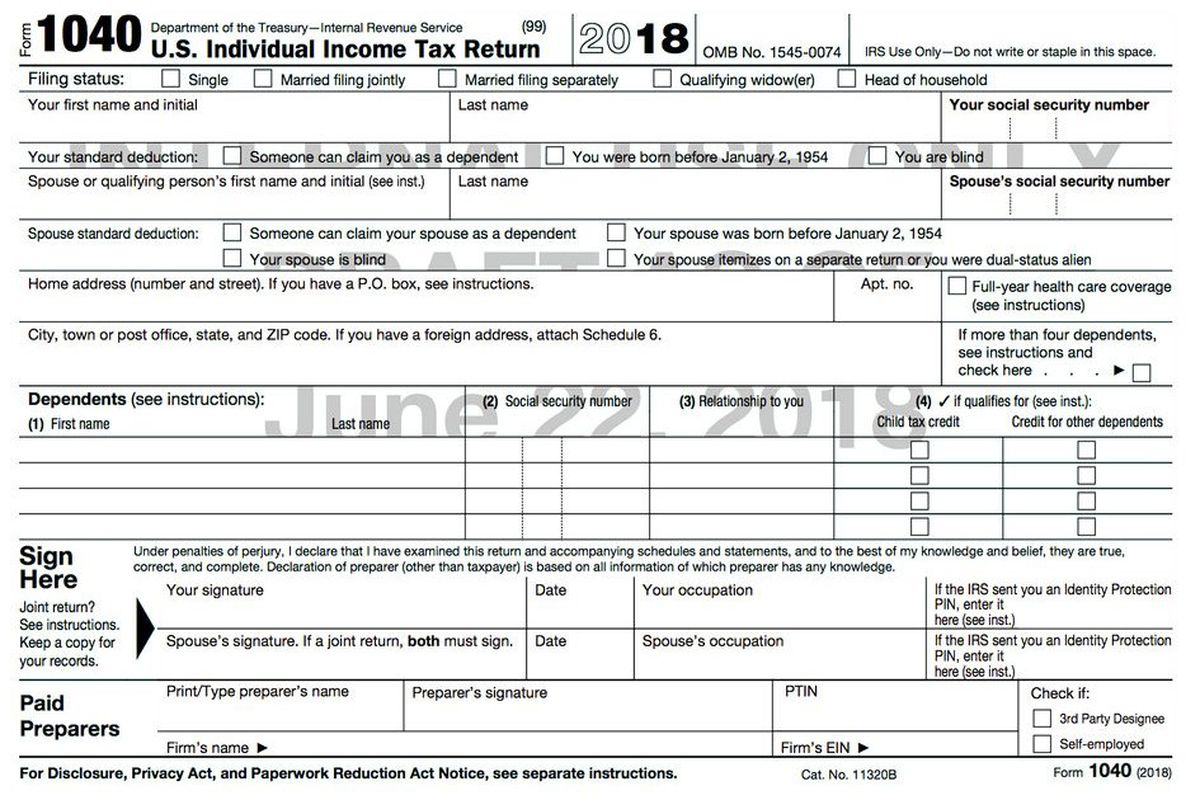

- The IRS Shrinks The 1040 Tax Form But The Workload Stays

While not specific to Pennsylvania state taxes, understanding the 1040 tax form is crucial for Asian people living in the United States. The IRS has made changes to the 1040 form to simplify the tax filing process. It is important to stay informed about any updates or changes made by the IRS, ensuring accurate reporting of income, deductions, and credits.

While not specific to Pennsylvania state taxes, understanding the 1040 tax form is crucial for Asian people living in the United States. The IRS has made changes to the 1040 form to simplify the tax filing process. It is important to stay informed about any updates or changes made by the IRS, ensuring accurate reporting of income, deductions, and credits.

In conclusion, the forms mentioned above are just a few examples of the paperwork required for filing state taxes in Pennsylvania. By accurately completing these forms, Asian people can ensure compliance with state regulations and avoid any unnecessary penalties or legal complications. Remember to consult with a tax professional or refer to the official sources to obtain the most up-to-date and accurate information for successfully filing your taxes.