Hey there! Are you ready to dive into the fascinating world of tax forms? We know, it might not be the most thrilling topic, but trust us, understanding these forms is essential for keeping your financials in order. Let’s take a closer look at some key 1099 forms and what you need to know about them.

1099 2023 Form - Editable PDF

First up, we have the 1099 2023 Form - an editable PDF that makes your life so much easier. This handy form is designed to help you accurately report income other than salaries, tips, and wages. Whether you need to report rental income, freelance earnings, or any other type of income, this form has got you covered! With the convenience of being an editable PDF, you can simply fill in the required details on your computer and save it for future reference.

First up, we have the 1099 2023 Form - an editable PDF that makes your life so much easier. This handy form is designed to help you accurately report income other than salaries, tips, and wages. Whether you need to report rental income, freelance earnings, or any other type of income, this form has got you covered! With the convenience of being an editable PDF, you can simply fill in the required details on your computer and save it for future reference.

For the Love of 1099s! Preparing for JD Edwards Year-End – Circular

Next, we have “For the Love of 1099s! Preparing for JD Edwards Year-End” - a circular that dives into the world of 1099s, specifically focusing on preparing for JD Edwards Year-End. This informative resource provides valuable insights into how to navigate the year-end process and ensure accurate reporting. By staying on top of your 1099s, you can avoid penalties and maintain a clean financial record.

Next, we have “For the Love of 1099s! Preparing for JD Edwards Year-End” - a circular that dives into the world of 1099s, specifically focusing on preparing for JD Edwards Year-End. This informative resource provides valuable insights into how to navigate the year-end process and ensure accurate reporting. By staying on top of your 1099s, you can avoid penalties and maintain a clean financial record.

What Is a 1099 Form, and How Do I Fill It Out? | Bench Accounting

If you’ve ever wondered what a 1099 form is and how to fill it out correctly, this guide from Bench Accounting has got you covered. It breaks down the basics of 1099 forms and provides step-by-step instructions on how to fill them out accurately. Whether you’re a freelancer, independent contractor, or small business owner, understanding the ins and outs of these forms is crucial for meeting your tax obligations.

If you’ve ever wondered what a 1099 form is and how to fill it out correctly, this guide from Bench Accounting has got you covered. It breaks down the basics of 1099 forms and provides step-by-step instructions on how to fill them out accurately. Whether you’re a freelancer, independent contractor, or small business owner, understanding the ins and outs of these forms is crucial for meeting your tax obligations.

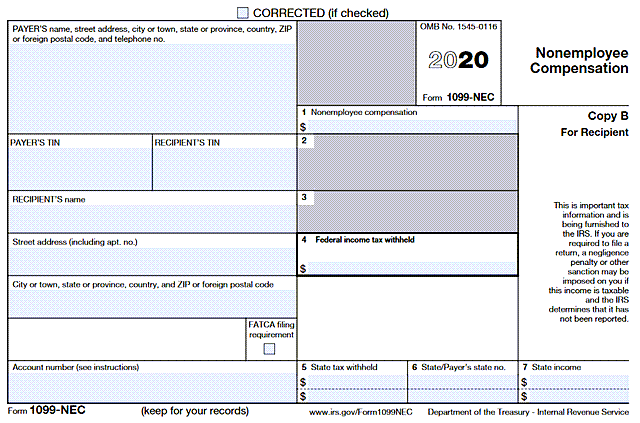

Memo - For 2020, 1099-NEC Replaces 1099-MISC For (NEC) Non-Employee

Here’s a memo that highlights an important change in the 1099 landscape. In 2020, the 1099-NEC replaced the 1099-MISC for (NEC) non-employee reporting. This change streamlines the process and ensures clarity in reporting income for non-employees. So, if you’re a business owner or employer, make sure to stay up to date with these changes to avoid any confusion or potential errors.

Here’s a memo that highlights an important change in the 1099 landscape. In 2020, the 1099-NEC replaced the 1099-MISC for (NEC) non-employee reporting. This change streamlines the process and ensures clarity in reporting income for non-employees. So, if you’re a business owner or employer, make sure to stay up to date with these changes to avoid any confusion or potential errors.

What the 1099-NEC Coming Back Means for your Business - Chortek

Curious about what the return of the 1099-NEC means for your business? Look no further than this informative resource from Chortek. The 1099-NEC form brings changes to how businesses report non-employee compensation. It’s important to understand these changes and ensure compliance with the IRS regulations. This comprehensive guide will walk you through everything you need to know and how it impacts your business.

Curious about what the return of the 1099-NEC means for your business? Look no further than this informative resource from Chortek. The 1099-NEC form brings changes to how businesses report non-employee compensation. It’s important to understand these changes and ensure compliance with the IRS regulations. This comprehensive guide will walk you through everything you need to know and how it impacts your business.

QuickBooks 1099 Tax Form Changes at 2020 Year-end

Are you a QuickBooks user? Then you need to stay informed about the 1099 tax form changes that came into effect at the 2020 year-end. This informative guide from QuickBooks will walk you through the updates and provide valuable insights on how to navigate the changes seamlessly within the QuickBooks software. Stay on top of your tax reporting game with this helpful resource.

Are you a QuickBooks user? Then you need to stay informed about the 1099 tax form changes that came into effect at the 2020 year-end. This informative guide from QuickBooks will walk you through the updates and provide valuable insights on how to navigate the changes seamlessly within the QuickBooks software. Stay on top of your tax reporting game with this helpful resource.

2020 W-9 Form Printable | Example Calendar Printable

Ah, the W-9 form. If you’re a small business owner, chances are you’ve come across this form at some point. This printable W-9 form example from Example Calendar Printable provides a clear understanding of what information is required and how to fill it out correctly. By ensuring accurate completion of W-9 forms, you can ensure proper reporting and avoid any potential issues down the line.

Ah, the W-9 form. If you’re a small business owner, chances are you’ve come across this form at some point. This printable W-9 form example from Example Calendar Printable provides a clear understanding of what information is required and how to fill it out correctly. By ensuring accurate completion of W-9 forms, you can ensure proper reporting and avoid any potential issues down the line.

1099 Form 2020 📝 Get IRS Form 1099 Printable Blank PDF: Online Tax Form

If you’re looking for a printable blank PDF version of the 1099 form, look no further. This website offers a convenient way to access the official IRS Form 1099 in a printable format. It’s always good to have a reliable source for obtaining these important forms and ensuring accurate reporting.

If you’re looking for a printable blank PDF version of the 1099 form, look no further. This website offers a convenient way to access the official IRS Form 1099 in a printable format. It’s always good to have a reliable source for obtaining these important forms and ensuring accurate reporting.

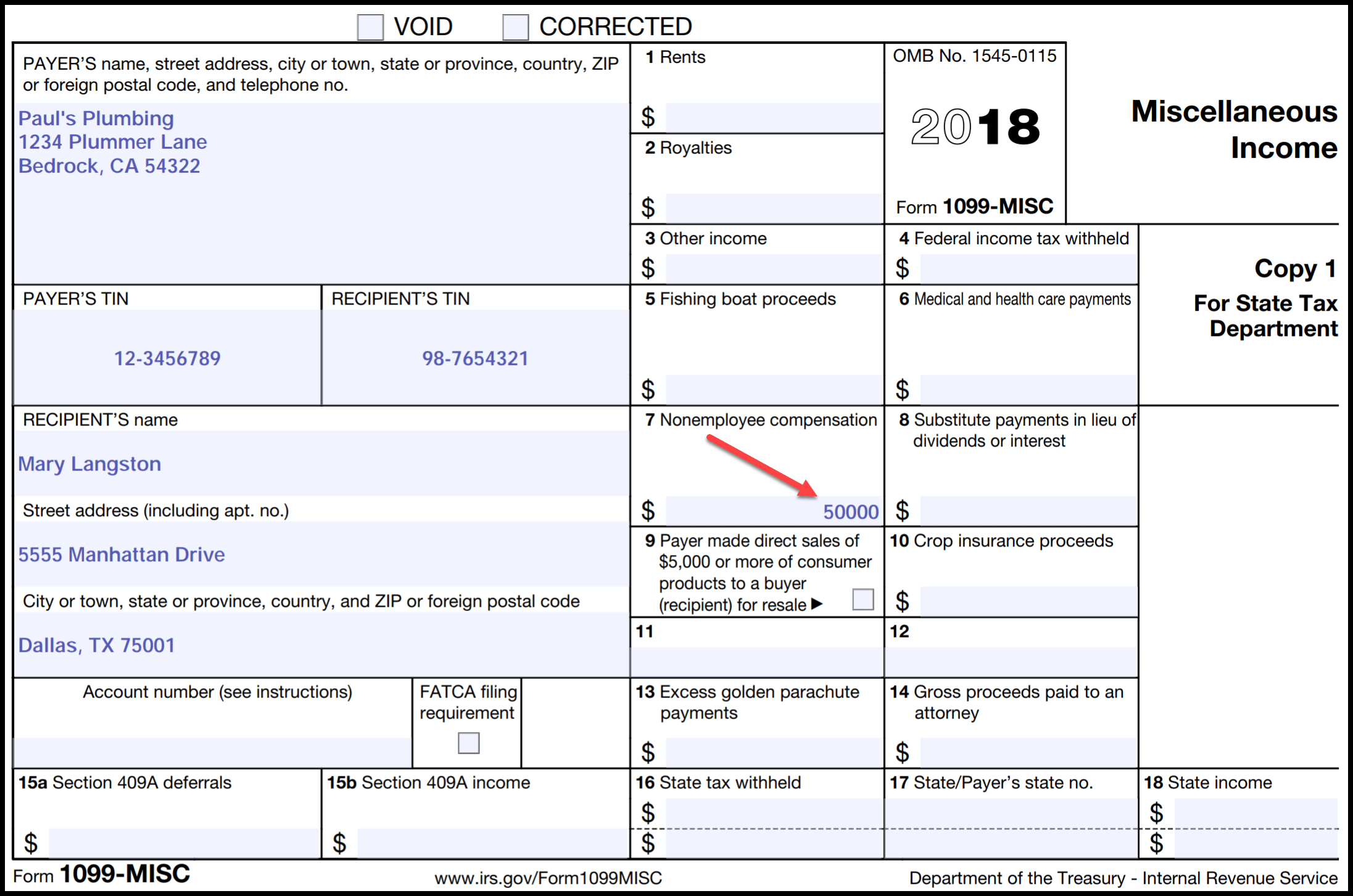

What Is Form 1099-MISC? When Do I Need to File a 1099-MISC? | Gusto

Form 1099-MISC is another crucial form that you may need to file under certain circumstances. Gusto, a trusted resource for payroll and HR services, provides insightful information on what the 1099-MISC form is and when you need to file it. By understanding the requirements and deadlines associated with this form, you can ensure compliance and avoid any potential penalties.

Form 1099-MISC is another crucial form that you may need to file under certain circumstances. Gusto, a trusted resource for payroll and HR services, provides insightful information on what the 1099-MISC form is and when you need to file it. By understanding the requirements and deadlines associated with this form, you can ensure compliance and avoid any potential penalties.

TSP 2020 Form 1099-R Statements Should Be Examined Carefully

If you have a Thrift Savings Plan (TSP) and received a Form 1099-R statement, it’s crucial to examine it carefully. This form contains valuable information related to distributions from your TSP account. By carefully reviewing the details provided in the statement, you can ensure accurate tax reporting and avoid any potential discrepancies.

If you have a Thrift Savings Plan (TSP) and received a Form 1099-R statement, it’s crucial to examine it carefully. This form contains valuable information related to distributions from your TSP account. By carefully reviewing the details provided in the statement, you can ensure accurate tax reporting and avoid any potential discrepancies.

We hope this overview of various 1099 forms has been helpful in shedding light on these essential tax documents. Remember, accurate reporting is key to maintaining clean financial records and avoiding any unnecessary penalties. If you have any further questions or require additional information, consult with a qualified tax professional.