Printable Blank W9 Form | Example Calendar Printable

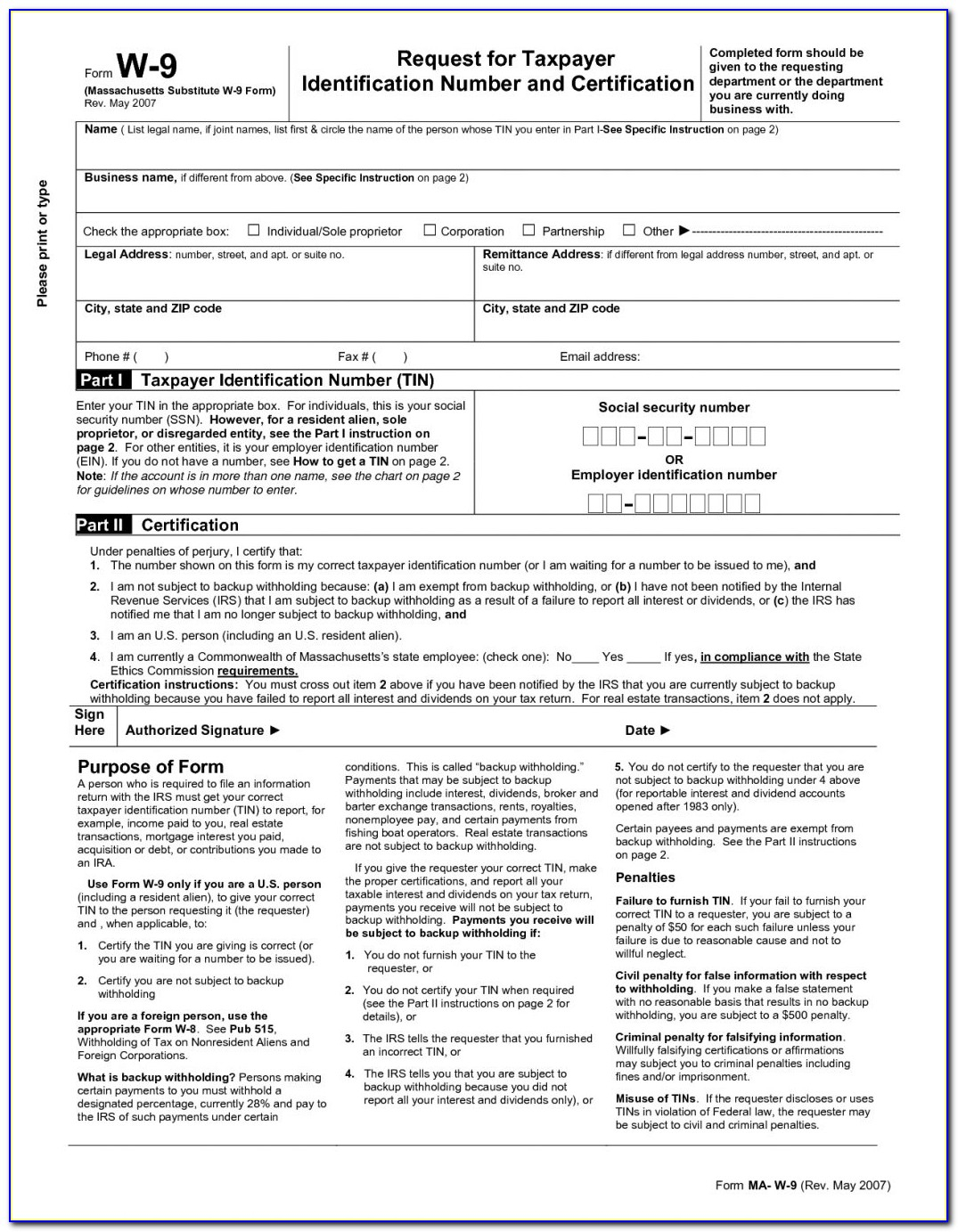

Image 1:

A W9 form is a document that individuals or businesses use to provide their taxpayer identification number (TIN) to the Internal Revenue Service (IRS). It is commonly used when someone needs to report income earned by another individual or business entity.

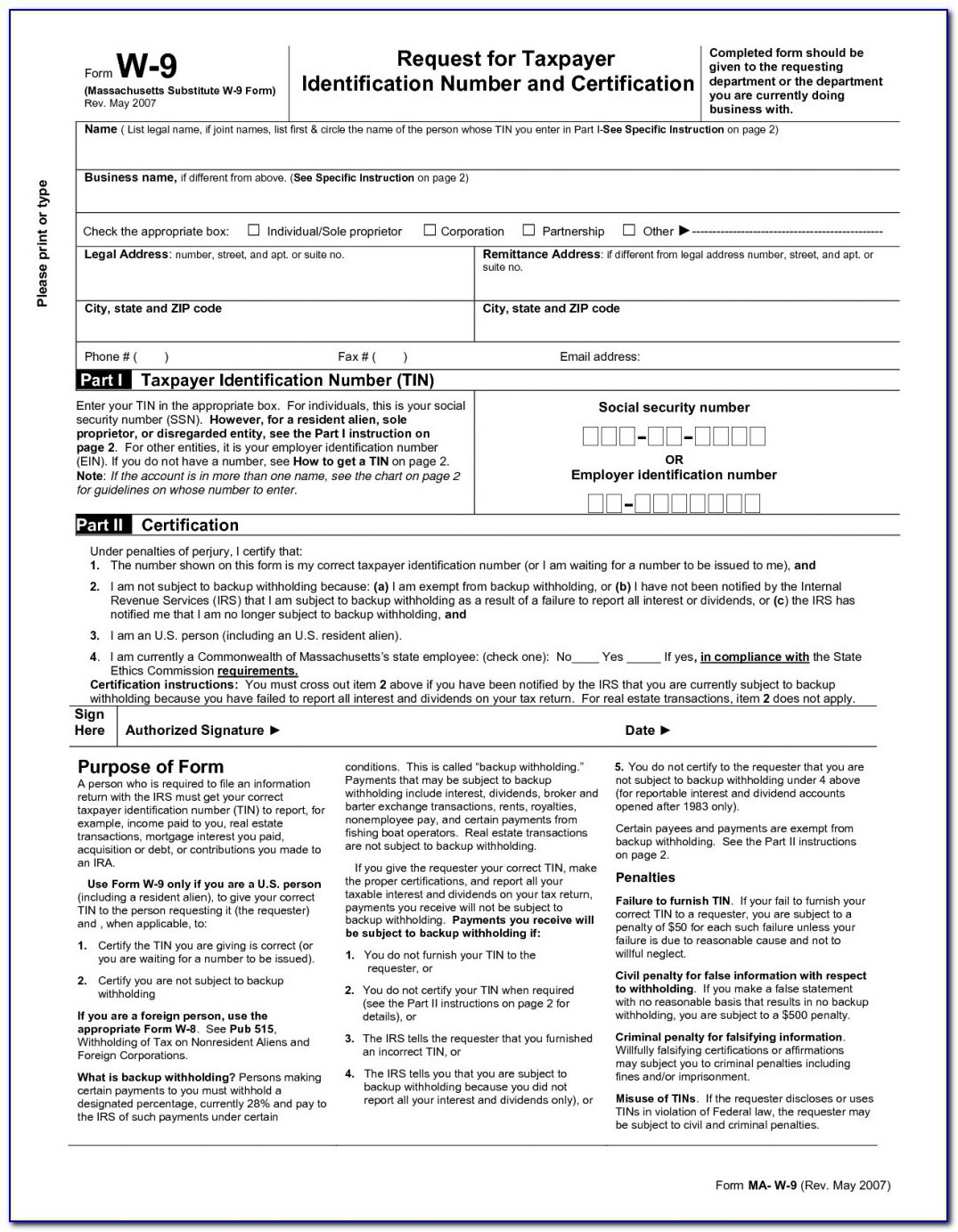

Image 2:

The W9 form serves as a request for the taxpayer’s identification number, which could be a Social Security Number (SSN) or an Employer Identification Number (EIN). This form is typically used by employers, financial institutions, and other entities that need to report income payments to the IRS.

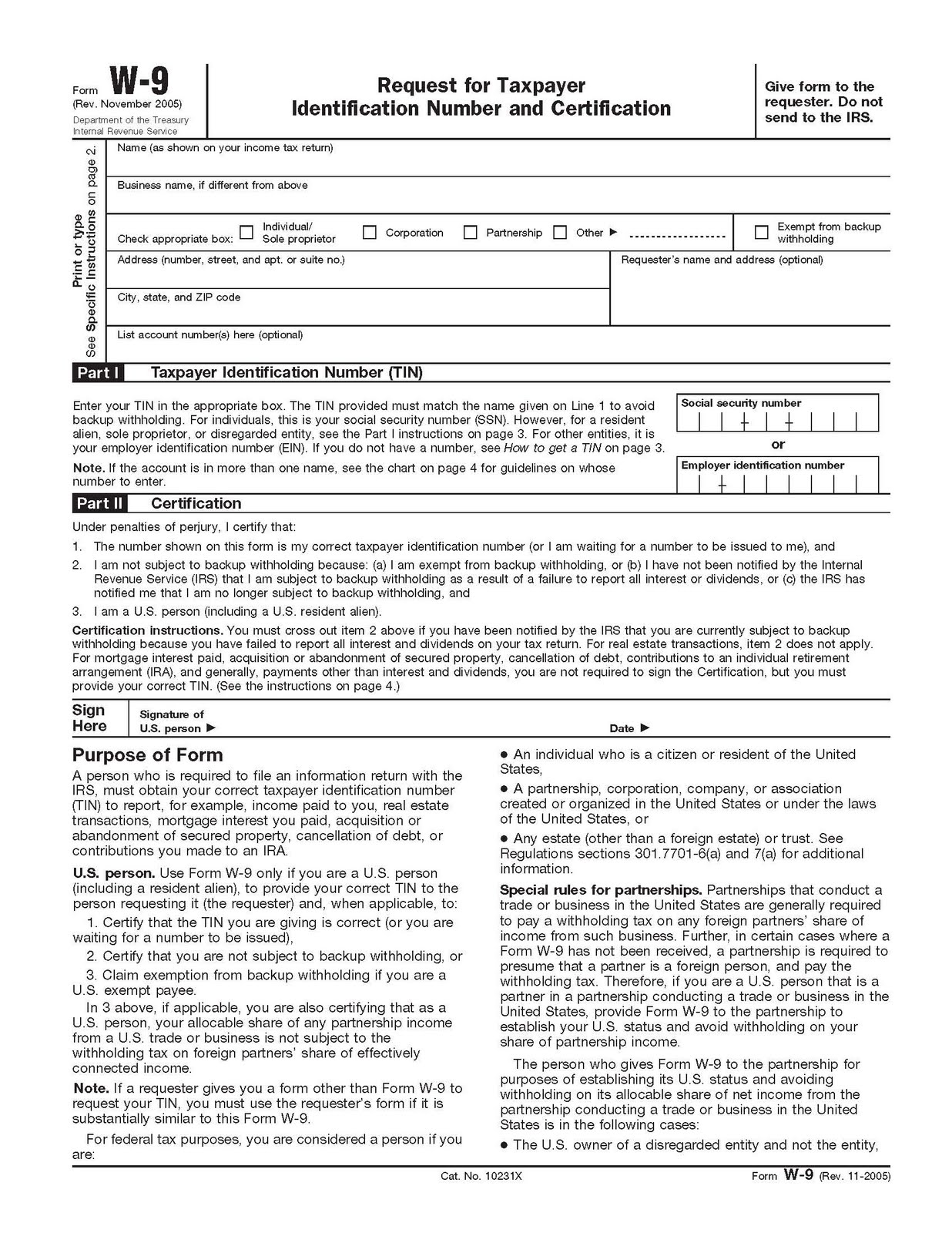

Image 3:

The blank W9 form featured in this image is an essential tool for businesses and individuals alike, as it ensures accurate, reliable reporting of financial information to the IRS. The form collects key details such as the name, address, and TIN of the taxpayer.

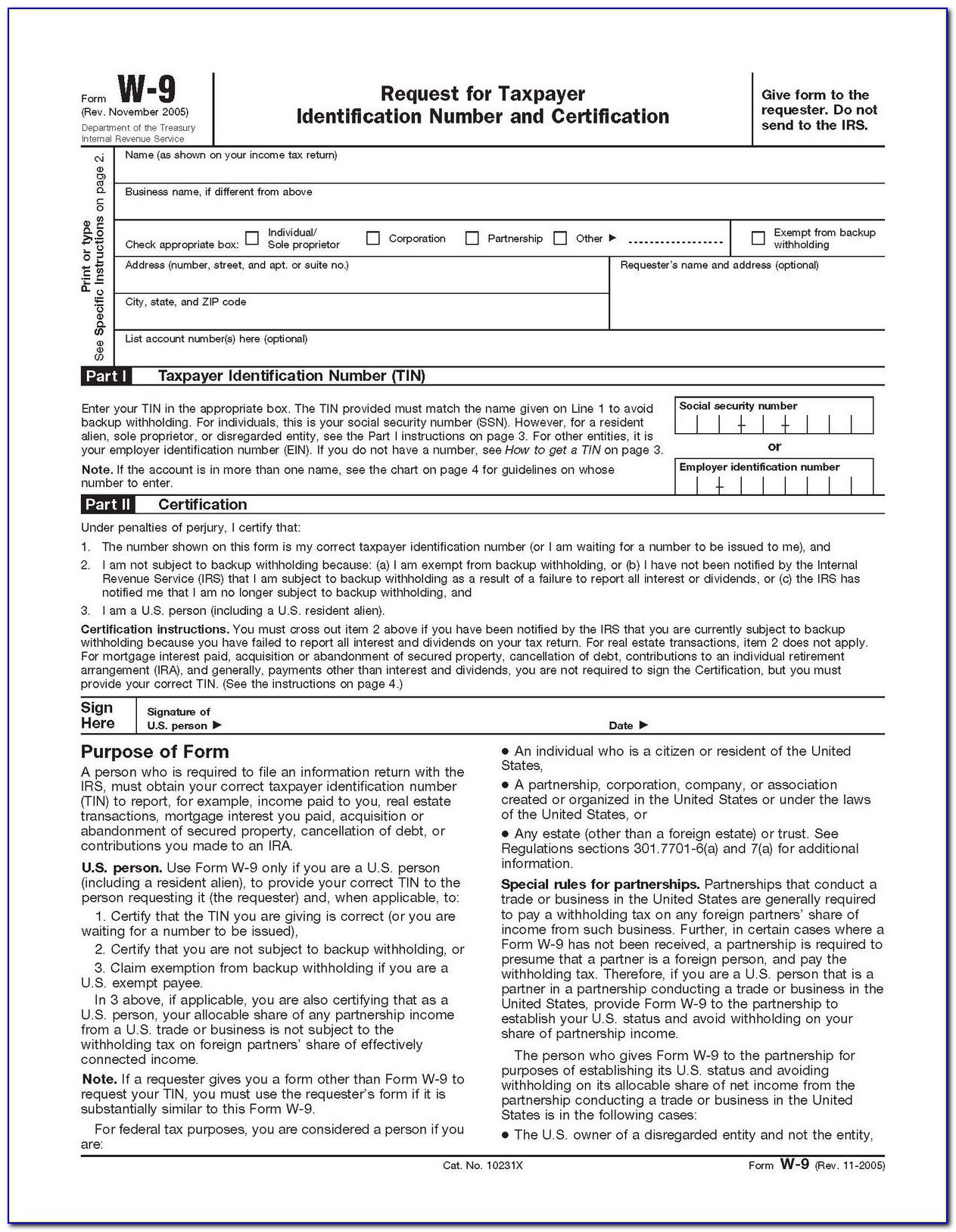

Image 4:

This image highlights a downloadable W9 tax form and provides crucial information on how to fill it out correctly. It underscores the significance of accurate completion to avoid potential tax-related issues.

Image 5:

This image references a free printable W9 form for the year 2016. It emphasizes the convenience and accessibility of finding printable forms online, eliminating the need for physical copies.

These are just a few examples of the various blank W9 forms available for different purposes. It is crucial to select the appropriate form based on the specific requirements and guidelines provided by the IRS or the requesting party. By utilizing these forms correctly, individuals and businesses can ensure compliant reporting and avoid potential penalties or legal complications related to inaccuracies or omissions on their tax forms.

It is worth noting that while these images provide visual representations of blank W9 forms, it is recommended to download the official forms directly from the IRS or trusted sources to ensure the most up-to-date and accurate versions. This ensures compliance with legal requirements and minimizes the risk of submitting outdated or incorrect information.

Whether you are an employer hiring independent contractors, a financial institution making payments to account holders, or an individual engaging in certain financial transactions, understanding the importance of the W9 form and its proper completion is vital. By familiarizing yourself with the purpose and significance of this form, you can navigate the reporting process with confidence and ensure compliance with the IRS guidelines.

Remember to consult with a tax professional or visit the official IRS website for any specific questions or concerns related to your unique tax situation. Stay informed and organized to fulfill your tax obligations accurately and efficiently.