Here we go with another important form that you need to know about - the W-9 form! In this post, we’ll be discussing the W-9 form, its significance, and how you can easily get access to printable versions.

What is the W-9 form?

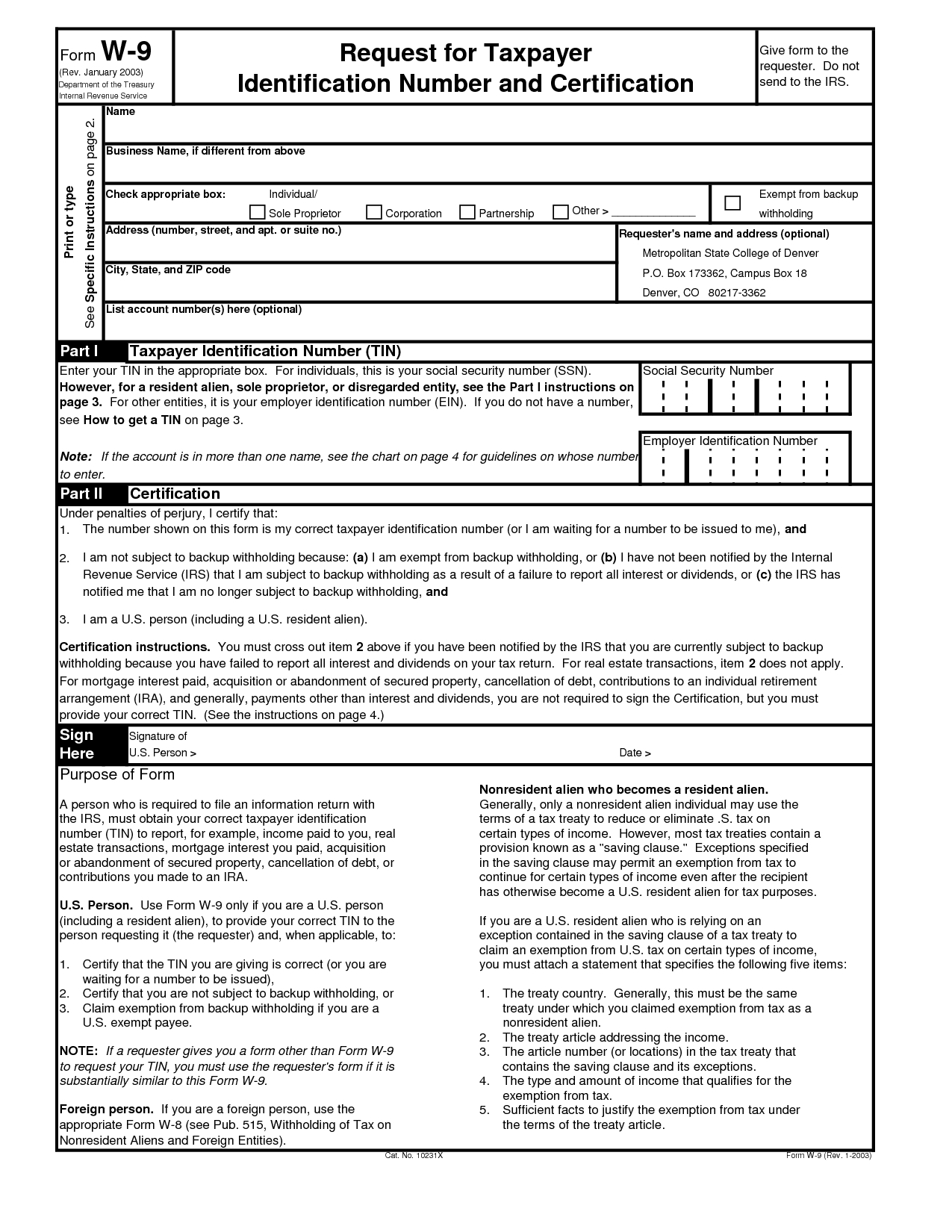

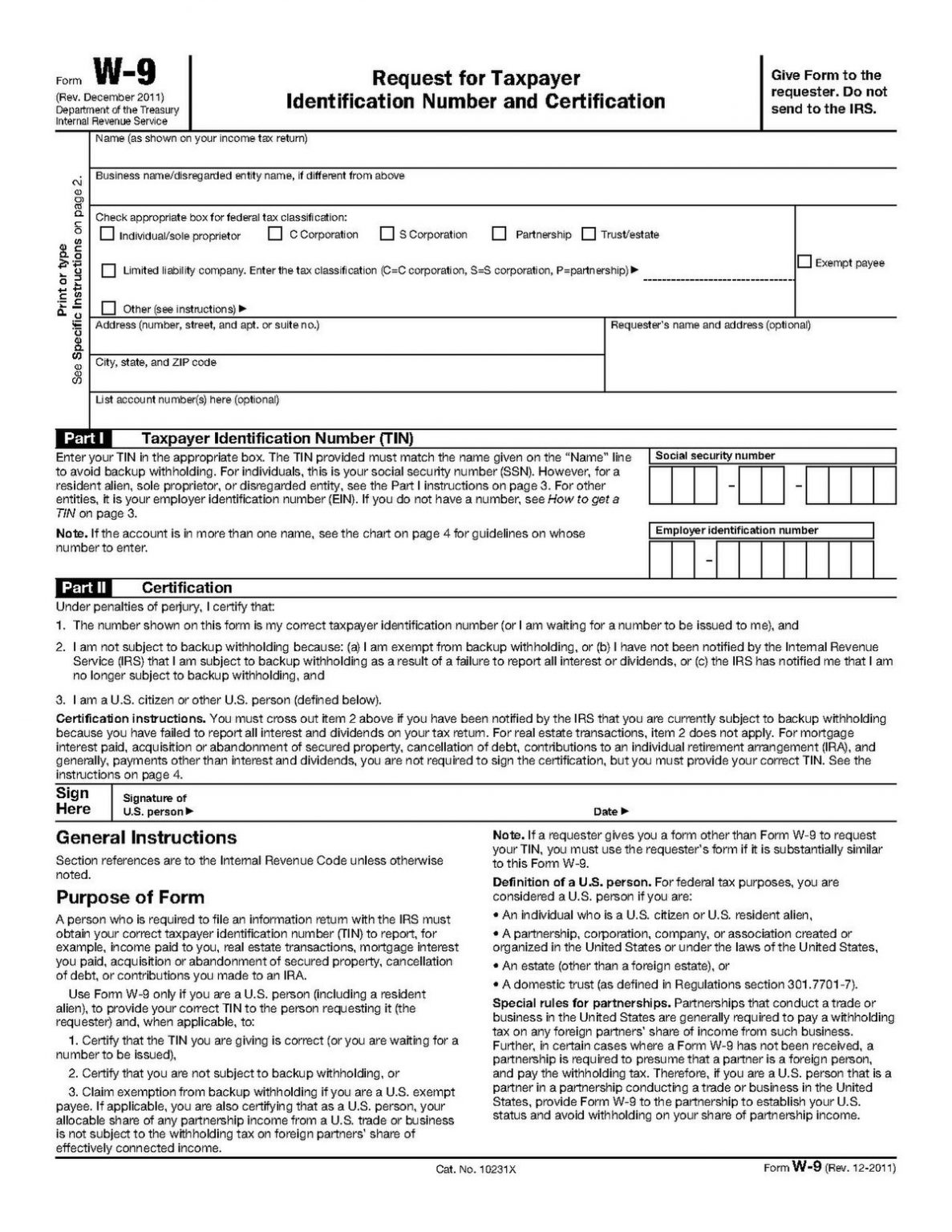

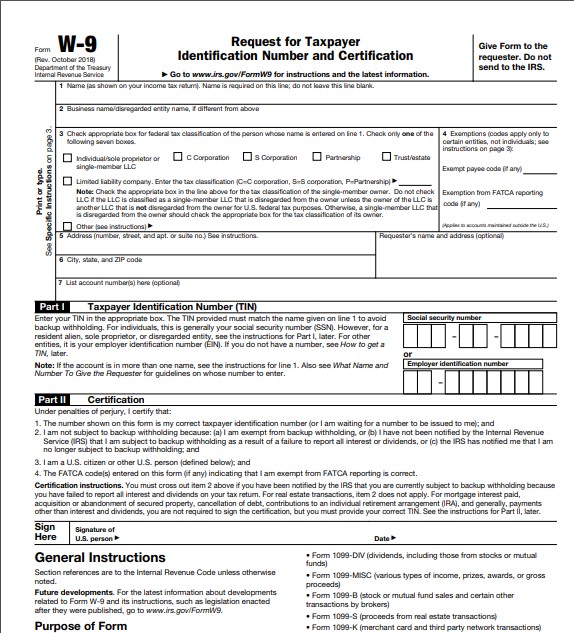

If you’re wondering what the W-9 form is all about, let me break it down for you. The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is an important document used by individuals and businesses to collect information from independent contractors or freelancers. The purpose of this form is to gather the necessary details, such as the individual’s name, address, and taxpayer identification number, for tax reporting purposes.

If you’re wondering what the W-9 form is all about, let me break it down for you. The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is an important document used by individuals and businesses to collect information from independent contractors or freelancers. The purpose of this form is to gather the necessary details, such as the individual’s name, address, and taxpayer identification number, for tax reporting purposes.

Why is the W-9 form important?

The W-9 form holds significant importance for both the payer and the payee. For the payer, it ensures that they have accurate information about the person or business they are making payments to. This information is crucial for reporting purposes to the Internal Revenue Service (IRS). On the other hand, for the payee, providing the required information on the W-9 form ensures that they are accurately identified and receive the necessary tax documents, such as the 1099-MISC form, at the end of the year.

The W-9 form holds significant importance for both the payer and the payee. For the payer, it ensures that they have accurate information about the person or business they are making payments to. This information is crucial for reporting purposes to the Internal Revenue Service (IRS). On the other hand, for the payee, providing the required information on the W-9 form ensures that they are accurately identified and receive the necessary tax documents, such as the 1099-MISC form, at the end of the year.

Where can you find printable W-9 forms?

If you’re looking for printable versions of the W-9 form, you’re in luck! You can easily find various websites offering downloadable and printable W-9 forms. One such website is Zrivo, where you can find the updated Form W-9 for the year 2023. The form is available in PDF format, making it convenient for you to fill in the required details and print it out.

If you’re looking for printable versions of the W-9 form, you’re in luck! You can easily find various websites offering downloadable and printable W-9 forms. One such website is Zrivo, where you can find the updated Form W-9 for the year 2023. The form is available in PDF format, making it convenient for you to fill in the required details and print it out.

How to fill out the W-9 form?

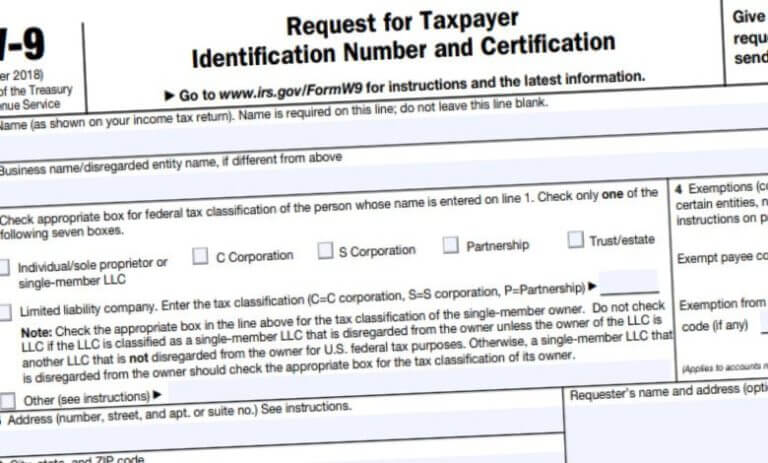

Now that you have the printable W-9 form in your hands, let’s walk through the process of filling it out. The form consists of various sections that you need to complete:

Now that you have the printable W-9 form in your hands, let’s walk through the process of filling it out. The form consists of various sections that you need to complete:

1. Provide your name as it appears on your tax return.

2. Enter your business name, if applicable.

3. Fill in your address, including street, city, state, and ZIP code.

4. Provide your taxpayer identification number, which can be your Social Security Number (SSN) or Employer Identification Number (EIN).

5. Indicate your tax classification, whether you’re an individual, a sole proprietor, or a corporation.

6. Sign and date the form to certify that the information you have provided is correct.

Wrap Up

The W-9 form is an essential document for tax reporting purposes, and having access to printable versions makes it easier for both payers and payees to complete the necessary paperwork. We hope this post has provided you with valuable information on the W-9 form and its significance. Remember, it’s always important to consult a tax professional for any specific questions or concerns regarding your tax obligations.

The W-9 form is an essential document for tax reporting purposes, and having access to printable versions makes it easier for both payers and payees to complete the necessary paperwork. We hope this post has provided you with valuable information on the W-9 form and its significance. Remember, it’s always important to consult a tax professional for any specific questions or concerns regarding your tax obligations.

Disclaimer: The information provided in this post is for general informational purposes only and does not constitute legal or tax advice. For specific advice and guidance, please consult a qualified tax professional.